The dawn of the "Trump 2.0" era. Reflecting on his policies and their impact on the market during his term from 2016 to 2020, many investors are eager for a revival of his policies.

As a president inclined towards deregulation and economic growth, Trump's administration had a profound impact on multiple sectors, including energy, manufacturing, and technology. With his policies returning, will the US stock market see new investment opportunities? Which concept stocks may regain market attention?

How Will the Stock Market Perform After the Election?

Historically, the stock market has performed well during Trump's presidency, particularly driven by tax cuts and financial deregulation, which helped the market reach multiple new highs between 2017 and 2020. However, in the "Trump 2.0" era, market performance may depend on several key factors:

Interest Rate Policy and Inflation Expectations: Trump tends to pressure the Federal Reserve to maintain low interest rates, which could benefit growth-oriented industries, especially if the Fed maintains a hawkish stance on rates.

International Situation and Supply Chain Impact: Trump previously took a hardline stance against countries like China; if similar policies are continued, the market may face supply chain fluctuations, which could affect the performance of technology and manufacturing sectors.

Tax Cuts and Fiscal Spending: If Trump returns to office, he may continue large-scale tax cuts and increase fiscal spending, which would boost corporate profits and consumer spending, providing support for the stock market.

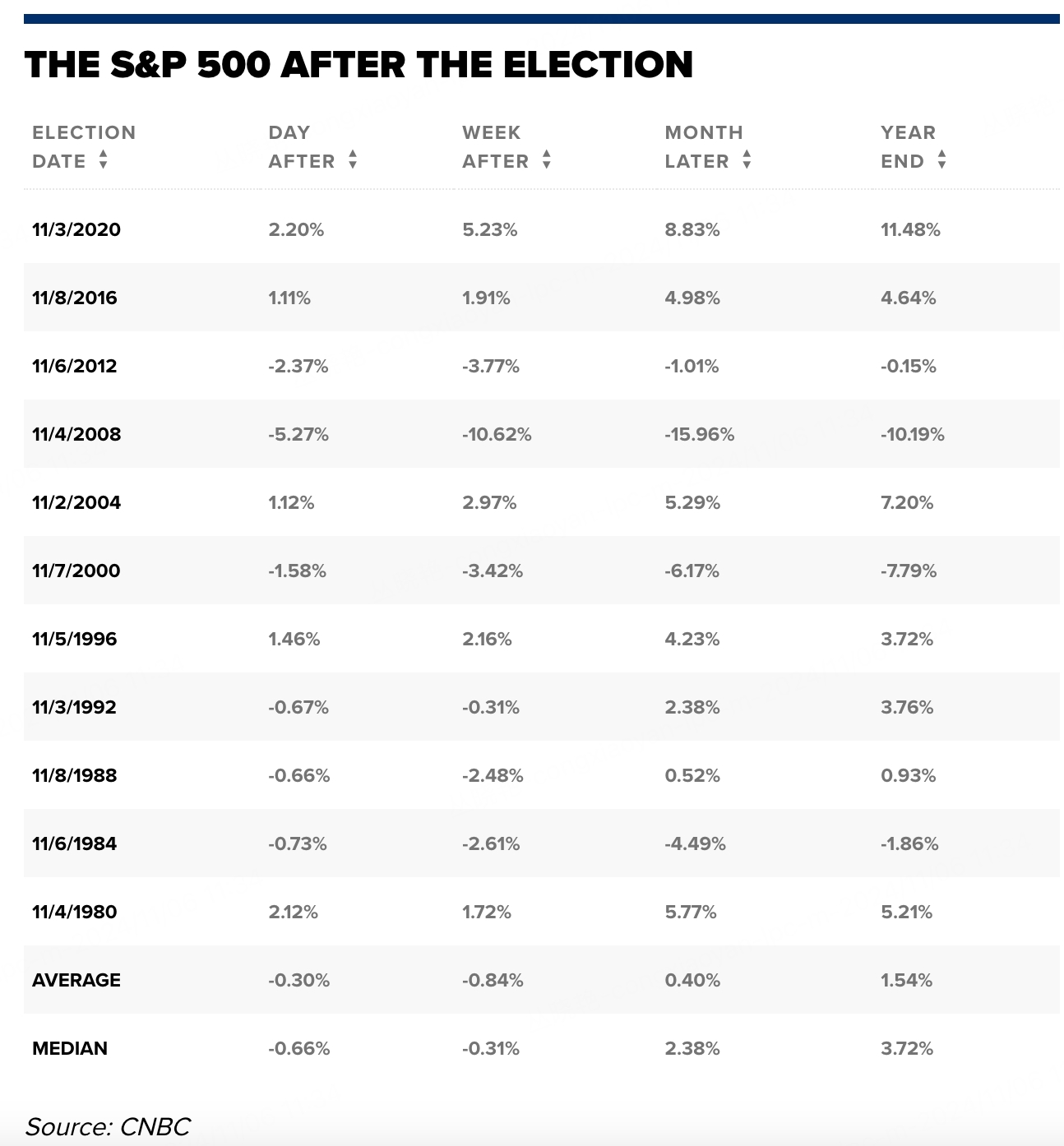

Historical data shows that stock markets typically rise after presidential elections, but investors must first be prepared for short-term volatility.

According to CNBC data, since 1980, the three major benchmarks have averaged gains from election day to the end of the year during presidential election years. However, investors should not expect the stock market to rise sharply immediately after the votes are counted.

Trump's Policy Proposals

Trump's policy proposals continue to reflect his previous style: tax cuts and deregulation.

Tax Policy: Trump tends to maintain low tax policies, including keeping or further lowering corporate tax rates. His policies emphasize stimulating investment and economic growth through tax cuts.

Government Spending and Fiscal Policy: He tends to reduce government spending on social welfare and public projects while increasing spending on defense and security. His policies emphasize less government intervention and more reliance on market forces.

Trade Policy: Trump's "America First" policy emphasizes protecting US manufacturing through tariffs and bilateral agreements, which may exacerbate tensions with major trading partners, especially China.

Employment and Labor Policy: He opposes the federal government setting higher minimum wage standards and leans towards reducing labor regulations to increase business flexibility and lower hiring costs.

Healthcare Policy: He strongly opposes universal healthcare and supports market-oriented healthcare reforms to reduce the government's role in healthcare.

Energy Policy: Trump supports fossil fuels and opposes renewable energy, advocating for the removal of restrictions on US energy production.

Digital Currency: Trump is fully supportive of digital currencies, advocating for the removal of government regulation on digital currency transactions.

“Trump Trade”

Trump Media & Technology Group (TMTG) was founded by Donald Trump with the primary aim of providing a platform for free speech, especially after his social media accounts were banned from mainstream platforms. TMTG's main product is Truth Social, a social network targeted toward a conservative audience and designed to bolster Trump's political influence. The company's development is closely tied to Trump's personal brand and political career, particularly during his 2024 presidential campaign.

Tesla CEO Elon Musk is a staunch supporter of President Donald Trump and has spent millions of dollars supporting his campaign. As an American electric vehicle manufacturer, Tesla benefited from increased support for domestic manufacturing during Trump's administration, which will help drive Tesla's expansion in the US market.

Financial Regulation:

Traditional Energy & Oil:

Automobiles:

Tech

*T&Cs Apply. Capital at Risk. Not Investment Advice. Please visit our website for more details.