The 2024 US Presidential Election is scheduled to be held on Tuesday, November 5, 2024. The winner will assume office in January 2025 for a four-year term in the White House. Voters will also elect members of Congress, and this will impact the US economy post-2024, becoming a major source of uncertainty in the near term.

As the US election heats up, the market seems to have detected subtle shifts, with "smart money" beginning to go all-in on Trump winning the election.

Election Results Timeline

The 2024 US Presidential Election is set for Tuesday, November 5, 2024, marking the 60th US Presidential Election. At the same time, all 435 seats in the House of Representatives and 33 Senate seats will be contested, forming the 119th US Congress.

Daily Reports During Ballot Review (Preliminary)

Starting from Wednesday, November 6, the election office will release a report around 4 pm daily, indicating how many votes are yet to be counted.

Beginning on Thursday, November 7, an updated preliminary election result report will be published daily around 4 pm.

If no vote count or report update occurs on certain days, the election office will notify the public in advance.

Official Results Announcement

In normal circumstances, candidates may declare victory on election night. However, in 2020, it took several days to count all the votes. The election office will announce the final official results by December 5, 2024, at the latest.

*Source: https://www.sf.gov/zh-hant/november-5-2024-presidential-general-election-results-reporting-schedule

Latest Election Updates

Trump's Chances Rise

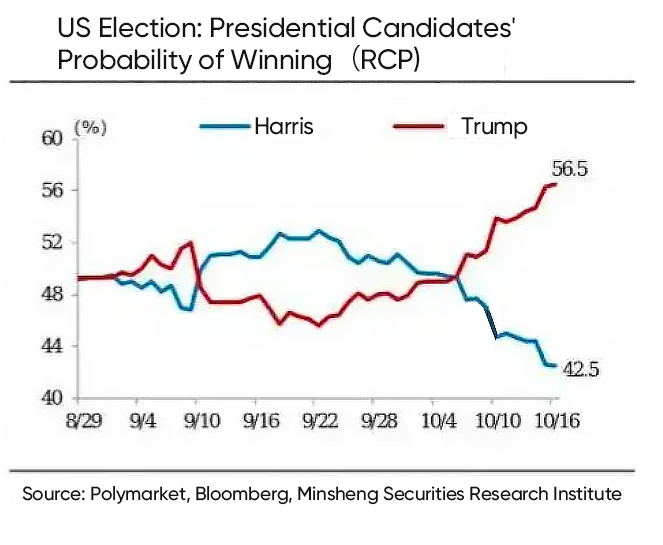

As of mid-October, Trump's chances of winning surpassed Harris'. As of October 16, Trump leads by 19 percentage points, according to Polymarket data.

Historically, Trump's performance is often underestimated by 3-5 percentage points in polls, and swing states tend to "flip red" at the last minute.

Wall Street Bets Big on "Trump Trade"

A report from JPMorgan on October 17 indicates that hedge fund capital flows show a strong preference for Republican-themed investments. Republican winners have been heavily bought in recent weeks, with holdings nearing a two-year high, while Democratic winners have been sold off, with positions at multi-year lows.

Goldman Sachs' top pre-election trade is based on a Republican victory, with their Republican victory basket hitting a record high.

UBS's Republican victory basket has also outperformed the Democratic basket, closing higher for 14 consecutive days.

How the Election Could Affect Asset Prices

US Stocks May Become More Volatile Before the Election, but Rise Afterward

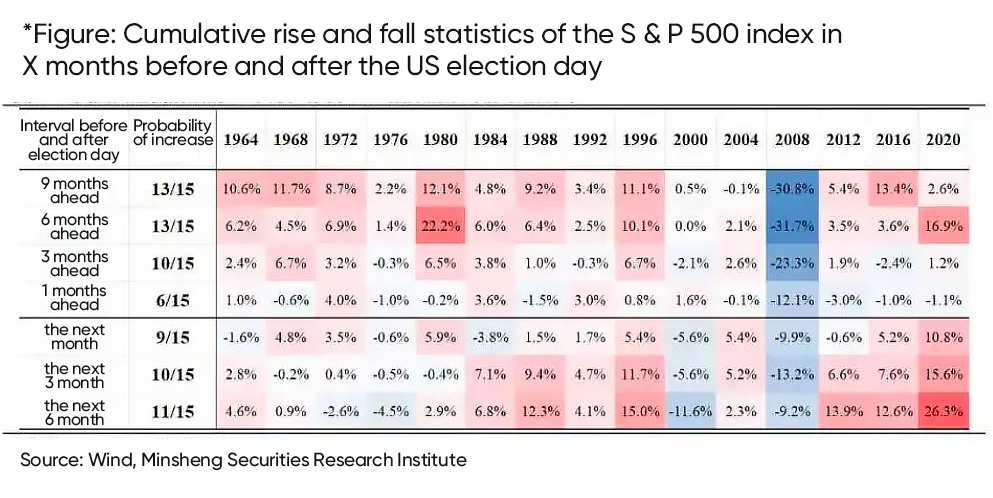

Historically, US stocks have become more volatile in the month leading up to elections, but they tend to rise after elections. Examining the S&P 500’s performance during the last 15 elections shows:

In the six months leading up to the election, US stocks rose 13 out of 15 times, likely due to the ruling party's political agenda, as a strong stock market helps their re-election chances.

In the month before the election, US stocks fell 9 out of 15 times, driven by risk-averse sentiment.

In the six months after the election, US stocks rose 11 out of 15 times.

Economic Comparison

Between Biden and Trump

Administrations

Economic Growth

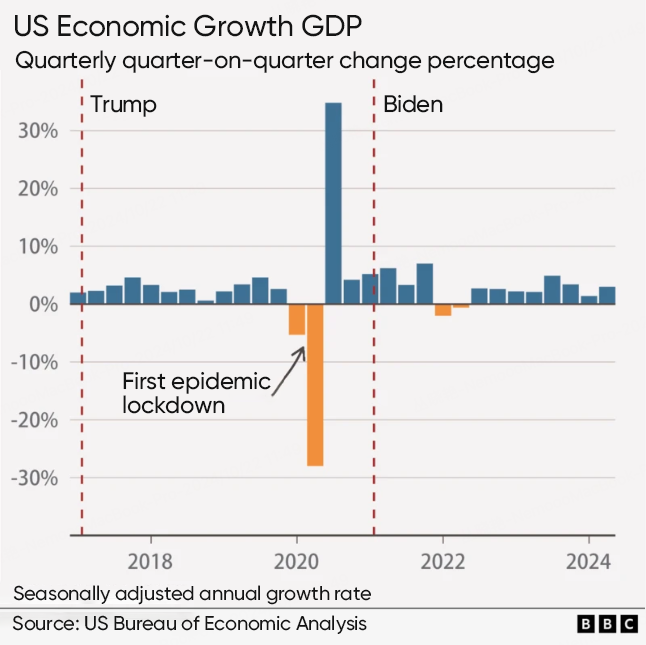

Under Trump, the average annual GDP growth rate was 2.3%, and despite the pandemic, the US economy rebounded strongly.

Under Biden, the average annual GDP growth rate was 2.2%, almost the same as under Trump. The US under Biden saw the strongest post-pandemic recovery among G7 nations.

Inflation

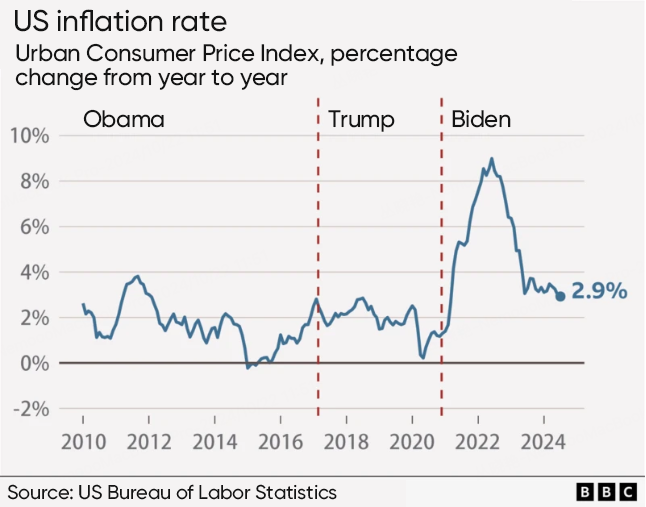

Inflation surged at the start of Biden's presidency, peaking at 9.1% in June 2022. Under Trump, inflation never reached such heights.

Though inflation has fallen to around 3%, it's still higher than when Trump left office. Some economists believe Biden’s "American Rescue Plan" contributed to rising prices.

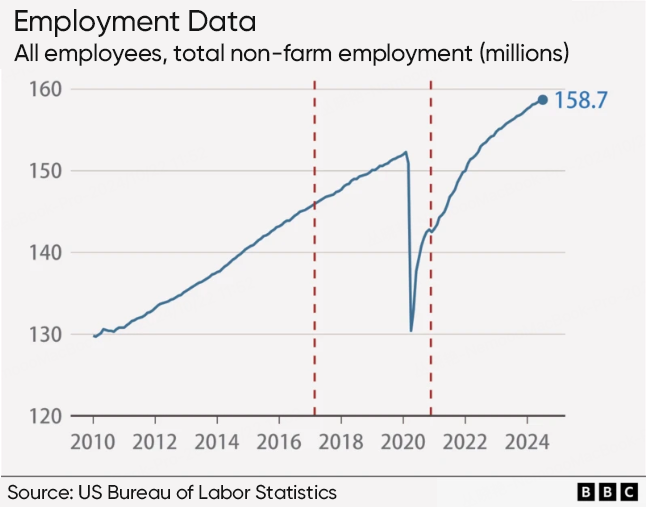

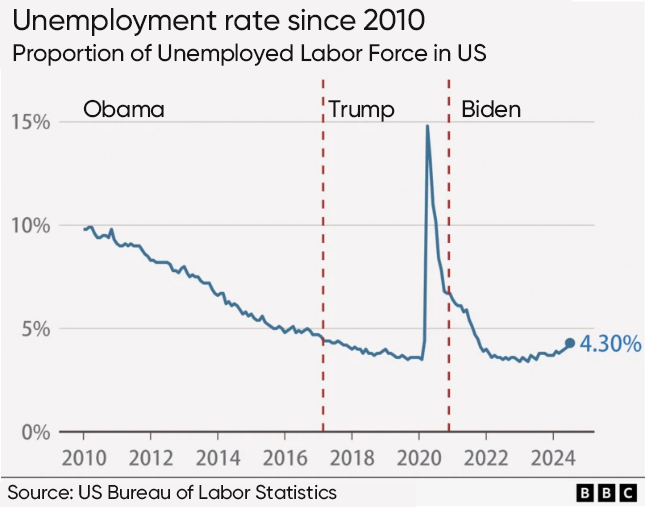

Employment Data

During Trump’s first three years, around 6.7 million jobs were added. Since Biden took office, nearly 16 million jobs have been added, marking the fastest job growth in any US president’s term.

The unemployment rate fell to 3.4% in early 2023 under Biden, the lowest in 50 years, but has since edged up.

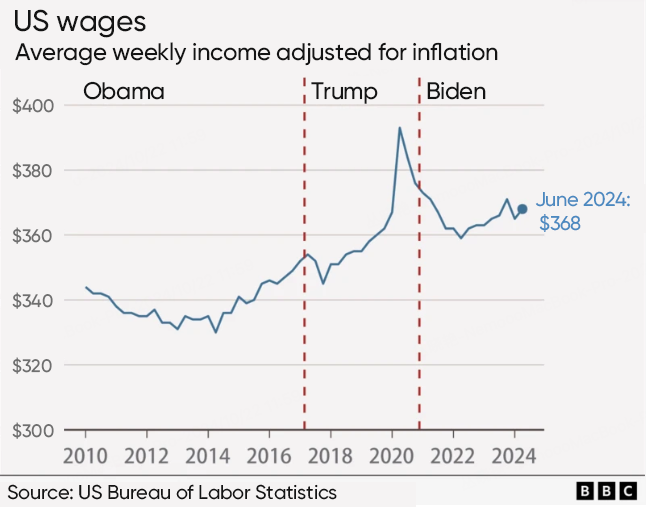

Wages

Wages rose under Trump, but during the pandemic, lower-wage workers were more likely to lose their jobs, pushing average wages up.

Under Biden, wages have risen, but inflation outpaced these increases, leaving real wages lower than when he took office.

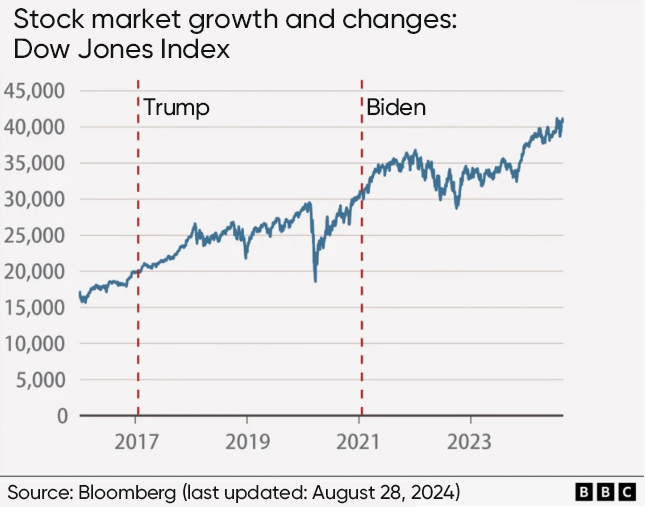

Financial Markets

Under Trump, the stock market surged early in his term, driven by tax cuts and deregulation, but later faced significant volatility due to the pandemic.

Under Biden, markets have shown more stable and sustained growth, even as inflation became a concern. The stock market hit new record highs during Biden’s presidency, showing robust growth.

If Trump Wins

Trump Media & Technology Group (TMTG) was founded by Donald Trump with the primary aim of providing a platform for free speech, especially after his social media accounts were banned from mainstream platforms. TMTG's main product is Truth Social, a social network targeted toward a conservative audience and designed to bolster Trump's political influence. The company's development is closely tied to Trump's personal brand and political career, particularly during his 2024 presidential campaign.

Financial Regulation

Traditional Energy & Oil

Automobiles

Tech

If Harris Gains the Upper Hand

Clean Energy

Infrastructure

Healthcare

Tech & Education

Sustainability

Real Estate & Construction

Electric Vehicles

Consumer Retail

Fintech

Source: https://www.bbc.com/zhongwen/simp/business-69317416

View more about the US election

*T&Cs Apply. Capital at Risk. Not Investment Advice. Please visit our website for more details.