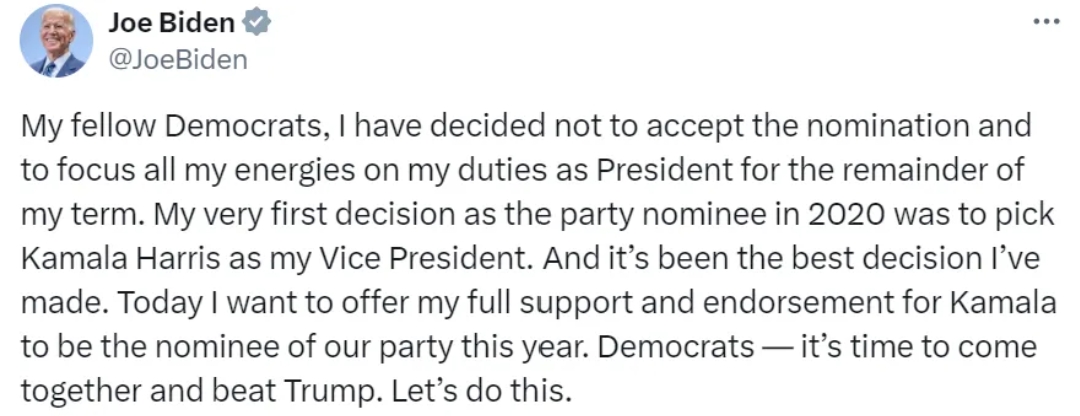

On July 21, local time, President Joe Biden announced his withdrawal from the 2024 presidential race. Biden stated that he made the decision in the best interest of the Democratic Party and the United States, and will fully support and endorse Vice President Kamala Harris for the Democratic presidential nomination.

Biden Drops Out!Harris Takes Over

On July 21, local time, U.S. President Joe Biden announced his withdrawal from the 2024 presidential election.

*Picture source:X

In a letter posted on his personal social media on the same day, Biden stated that he had initially intended to seek re-election. However, in the best interest of the Democratic Party and the United States, he has decided to withdraw from the presidential race and will focus on fulfilling his duties as President. He will fully support and endorse Vice President Kamala Harris for the Democratic presidential nomination.

After Biden's announcement of withdrawal, Trump commented on social media that Biden was unfit for re-election. He believes that if Harris secures the party nomination, she will be "easier to defeat than Biden" in the November election. Currently, Trump's campaign team is preparing for a contest against Harris.

The Impact of Harris Taking Over

If Harris successfully take the White House, it would mean that the "political pendulum has swung a bit back, leaning more towards the progressive wing."

1⃣️ Stock Market:

- J.P. Morgan: Believes that Harris's policies could lead to a rise in technology stocks, particularly in the renewable energy and healthcare sectors, due to her support for renewable energy and healthcare reform. Companies like Tesla, Nikola, and FirstSolar are expected to perform above average, while oil and gas companies like Apache and Pioneer Natural Resources may underperform.

- Goldman Sachs: Anticipates initial market volatility but remains positive on technology and green energy sectors in the long term.

2⃣️ Foreign Exchange Market:

- Citigroup: Suggests that Harris's foreign policy might lead to a weaker dollar due to her inclination towards more open international trade.

- UBS: Predicts that the dollar may experience short-term fluctuations, depending on the specifics of policy implementation.

3⃣️ Bond Market:

- BlackRock: Forecasts that under Harris's leadership, bond yields may rise due to her support for large-scale infrastructure investment plans.

- Vanguard: Expects that expansionary fiscal policies could lead to higher long-term government bond yields, but with limited short-term impact.

The Trump Attack Scene

At around 6:15 PM on July 13, Trump was at a campaign rally in Butler, Pennsylvania, when a suspected gunman fired several shots at the stage from a high vantage point outside the rally venue. Photographers captured images of subtle bloodstains on Trump's face and the ensuing chaos. According to preliminary determinations by on-site FBI investigators, the suspect in the assassination attempt was 20-year-old Thomas Matthew Crooks, a Republican from Pennsylvania, with motives still under investigation. The Crooks was subsequently killed by the US Secrete Service.

*Picture source:X

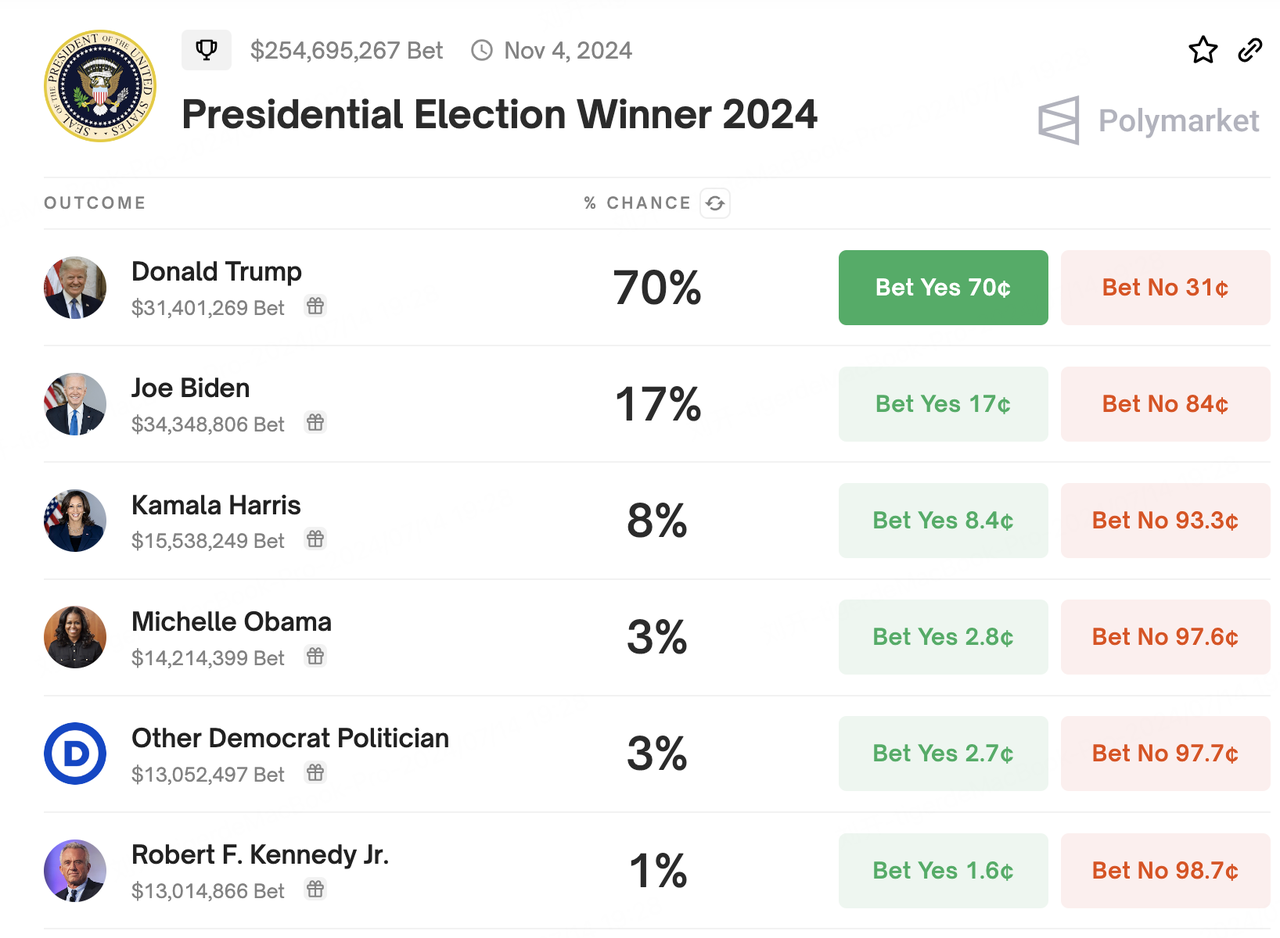

Trump's conduct at the scene was praised by the media. He left the scene under the protection of security personnel and gestured to his supporters. According to traders from the market prediction platform Polymarket, after the incident, the betting on whether Trump would win the presidential election increased by 10 cents, reaching 70 cents, indicating that investors now believe Trump has a 70% chance of winning in November.

*Picture source:Polymarket

Impact of the Trump attack on the market

US presidents have faced multiple assassination attempts. On March 30, 1981, Ronald Reagan was shot in Washington but survived. The stock market closed early that day due to the assassination attempt, with the S&P 500 index slightly down. The next day, the S&P 500 index rose by more than 1%, and the 10-year US Treasury yield fell by 9 basis points. Market commentators believe that the "Trump concept" will increasingly attract market attention, with funds betting on the Republican Party and Trump's victory. BCA Research's chief strategist Marko Papic believes that US Treasuries are the assets most affected by Trump's policies, and the US Treasury market may fluctuate as a result.

Trump is a supporter of cryptocurrencies and has stated that he will speak at the Nashville Cryptocurrency Conference in July. Tokens related to Trump saw significant increases, with MAGA rising by 34% and TREMP increasing by 67% within 24 hours.

Market reactions

Goldman Sachs' baseline predictions are as follows:

Republican Sweep: Modest equity rally, higher Treasury yields, stronger USD.

Democratic Sweep: Modest equity downside, higher Treasury yields, weaker USD.

Trump Win, Divided Government: Modest equity downside, slightly higher yields, stronger USD.

Biden Win, Divided Government: Flat equities, lower yields, weaker USD.

However, these outcomes could vary if Biden's fiscal proposals are larger or if the market reacts strongly to Trump's tariff proposals.

Goldman Sachs explains that if tariffs are implemented, stocks of companies with high international revenue may face resistance due to potential retaliatory tariffs and increased geopolitical tensions.

Despite the uncertainty around tariff increases, they seem likely if Trump wins, as he has considered imposing at least a 10% tariff on all imports to the US.

*Source: Yahoo Finance

Stocks benefiting from Trump's victory

"Trump Victory Stocks" include:

Banks and consumer finance companies benefiting from deregulation

Financial institutions benefiting from reduced merger scrutiny

Natural gas producers benefiting from relaxed regulations

Insurance companies offering broader coverage

Pharmaceutical companies facing reduced pricing pressures

Semiconductor, automotive, and steel manufacturers benefiting from trade protection policies

Stocks benefiting from Democratic Party Winning

Democratic Party Winning could favour companies involved in electrification policies. Such as electrical components and grid companies, clean hydrogen producers, energy efficiency product manufacturers, etc.

*T&Cs Apply. Capital at Risk. Not Investment Advice. Please visit our website for more details.