The People's Bank of China has announced a series of large-scale economic stimulus measures aimed at boosting the domestic economy and stabilizing financial markets. This initiative has quickly spread to international markets, especially the US stock market.

The State Council Information Office of China held a press conference at 10:00 am Beijing time on Saturday, October 12th, where Finance Minister Lan Fo’an discussed increasing countercyclical fiscal policy adjustments to support high-quality economic development. With recent strong monetary measures, market expectations are rising over how the enhanced fiscal policies will be executed.

On October 18th, the People's Bank of China, in collaboration with the State Administration of Financial Regulation and the China Securities Regulatory Commission, issued a notice regarding the establishment of stock repurchase and refinancing mechanisms. The policy encourages financial institutions to provide low-interest loans to eligible listed companies and major shareholders for stock repurchases and refinancing purposes. The initial funding is set at 300 billion RMB, with an annual interest rate of 1.75% and a one-year loan term, extendable as needed. Additionally, the People's Bank of China introduced the Securities, Fund, and Insurance Company Exchange Facility (SFISF), involving 20 participating securities and fund companies, with applications surpassing 200 billion RMB.

Buoyed by this positive news, related concept stocks in the U.S. and Hong Kong markets saw rapid gains. By the close of trading on October 18th, the Hang Seng Technology Index surged by 5.77%, reflecting the market's strong response to policy.

China Increases Counter-Cyclical Fiscal Policy Efforts

At a press conference held by the State Council Information Office, Minister of Finance Lan Fo'an discussed the implementation of proactive fiscal policies this year, as well as plans to strengthen counter-cyclical fiscal measures and promote high-quality economic development.

Expansion of Fiscal Expenditure

In 2024, the fiscal deficit is projected at 4.06 trillion yuan, with an additional 3.9 trillion yuan in local government special debt limits. An extra 1 trillion yuan will be raised through the issuance of ultra-long-term special bonds, bringing the total general public budget expenditure for the year to 28.55 trillion yuan.

Optimization of Tax and Fee Policies

From January to August, tax reductions, fee cuts, and tax rebates aimed at supporting technological innovation and the manufacturing sector exceeded 1.8 trillion yuan.

Expansion of Domestic Effective Demand

From January to September, 3.6 trillion yuan of new special bonds were issued, supporting over 30,000 projects, with more than 260 billion yuan used as project capital.

Strengthening of Basic Public Services and Key Areas

Central government transfer payments to local governments exceeded 10 trillion yuan, with increased support for science and technology, rural revitalization, and ecological civilization efforts.

Increased Support for Basic Livelihood Security

The central government allocated 66.7 billion yuan in employment subsidies, with over 3 trillion yuan spent on education nationwide from January to September. The government also raised basic pension levels for retirees and increased the minimum standard for urban and rural residents' pensions.

Mitigation of Local Government Debt Risks

In addition to the central government’s allocation of over 2.2 trillion yuan in local government debt limits, an additional 1.2 trillion yuan was set for 2024 to help local governments, especially in high-risk areas, mitigate existing debt risks.

Introduction of Incremental Policy Measures

Increased support for local governments to resolve debt risks, with a significant increase in debt limits to help manage hidden debts. This will allow localities to free up more energy and financial resources to promote development and ensure public welfare.

Issuance of special government bonds to support state-owned commercial banks in replenishing their core Tier 1 capital, enhancing these banks' ability to withstand risks and extend credit, thereby better serving the development of the real economy.

Combined use of local government special bonds, special funds, and tax policies to support stabilization efforts in the real estate market.

Strengthened support for key groups; before the National Day holiday, one-time living allowances were distributed to those in need. Future efforts will also target students, increasing support to enhance overall consumption capacity.

Dong Yu, Executive Vice President of the China Development Planning Institute at Tsinghua University, expressed confidence in the incremental policies. Given the current economic situation, investors should maintain faith in China’s incremental policies. The policy objectives include macroeconomic control, expanding domestic demand, and stabilizing the real estate market. It’s essential to focus on the overall policy framework rather than isolated data points. Moreover, understanding that policies are not just numerical games is crucial; their impact on market sentiment must also be considered. Moving forward, more policies will be introduced, and investors should pay attention to key measures, such as the progress in supporting the private economy and new urbanization efforts. This is just the beginning, signaling the central government’s commitment to economic work, and we can expect various favorable policies from different departments to support economic recovery in due course.

Overview of the Financial Stimulus

Current Policies:

To address the economic slowdown, the Chinese government has launched a series of policies known as the "financial stimulus," which includes measures like lowering reserve requirements, interest rate cuts, and reductions in existing mortgage rates. These initiatives aim to increase liquidity and reduce financing costs, thereby boosting investment confidence among businesses and individuals. Specific measures include:

RRR Cut (Reserve Requirement Ratio Cut): This measure directly injects liquidity into the banking system, with an expected release of up to 2 trillion yuan.

Interest Rate Cut: Aims to further lower financing costs for the real economy, boosting consumption and investment.

Liquidity Support for Financial Institutions: Eligible securities, funds, and insurance companies can access liquidity from the central bank through asset pledges.

Stock Repurchase Initiative: Establish a special project to facilitate stock buybacks. This includes guiding banks to extend loans and supporting listed companies and shareholders in repurchasing and increasing their stock holdings.

New Monetary Policy Tools: Develop innovative tools to foster the stable growth of the stock market.

Real Estate Market Support: Existing mortgage interest rates have been reduced, and down payment ratios lowered to encourage recovery in the real estate market and stimulate residential housing consumption.

Additionally, market expectations for stabilization funds are gradually rising. These funds aim to stabilize stock prices through direct intervention, similar to practices previously seen in Japan and South Korea. This suggests that China may adopt more direct market intervention measures to further boost market sentiment.

Impact of the Financial Stimulus

Will the Policy Last?

The sustainability of these policies largely depends on the speed of China's economic recovery and the global economic environment. The current policy framework includes both short-term liquidity measures and long-term structural reforms, aiming to maintain stable market development amid ongoing economic adjustments. For instance, reserve and interest rate cuts will provide long-term funding support, while mortgage rate adjustments are primarily to activate medium- to long-term demand in the real estate market.

Impact on the Stock Market:

Liquidity: The RRR and interest rate cuts have significantly boosted liquidity, facilitating a strong influx of funds into the stock market. As of September 27th, the Hang Seng Index rose by 3.55%, crossing the 20,000-point mark, with a record daily turnover of 445.748 billion Hong Kong dollars. In a liquidity-rich environment, funding costs have decreased, particularly benefiting capital-intensive sectors like real estate and finance. Additionally, the abundance of funds is likely to heighten investors' appetite for risky assets, further driving up stock market performance.

Policy Support: These policies clearly support traditional sectors such as real estate and infrastructure, while also positively impacting emerging sectors like technology and consumer goods. Notably, government policies explicitly support technological innovation and new infrastructure, which is a major boon for tech stocks and related companies.

International Impact:

Global capital markets are closely watching China’s economic policy direction. Despite ongoing uncertainties in US-China relations, the steady recovery of the Chinese economy offers significant opportunities for Chinese concept stocks, Hong Kong stocks, and a global allocation of Chinese assets. Investors generally remain optimistic about China’s important position in the global supply chain.

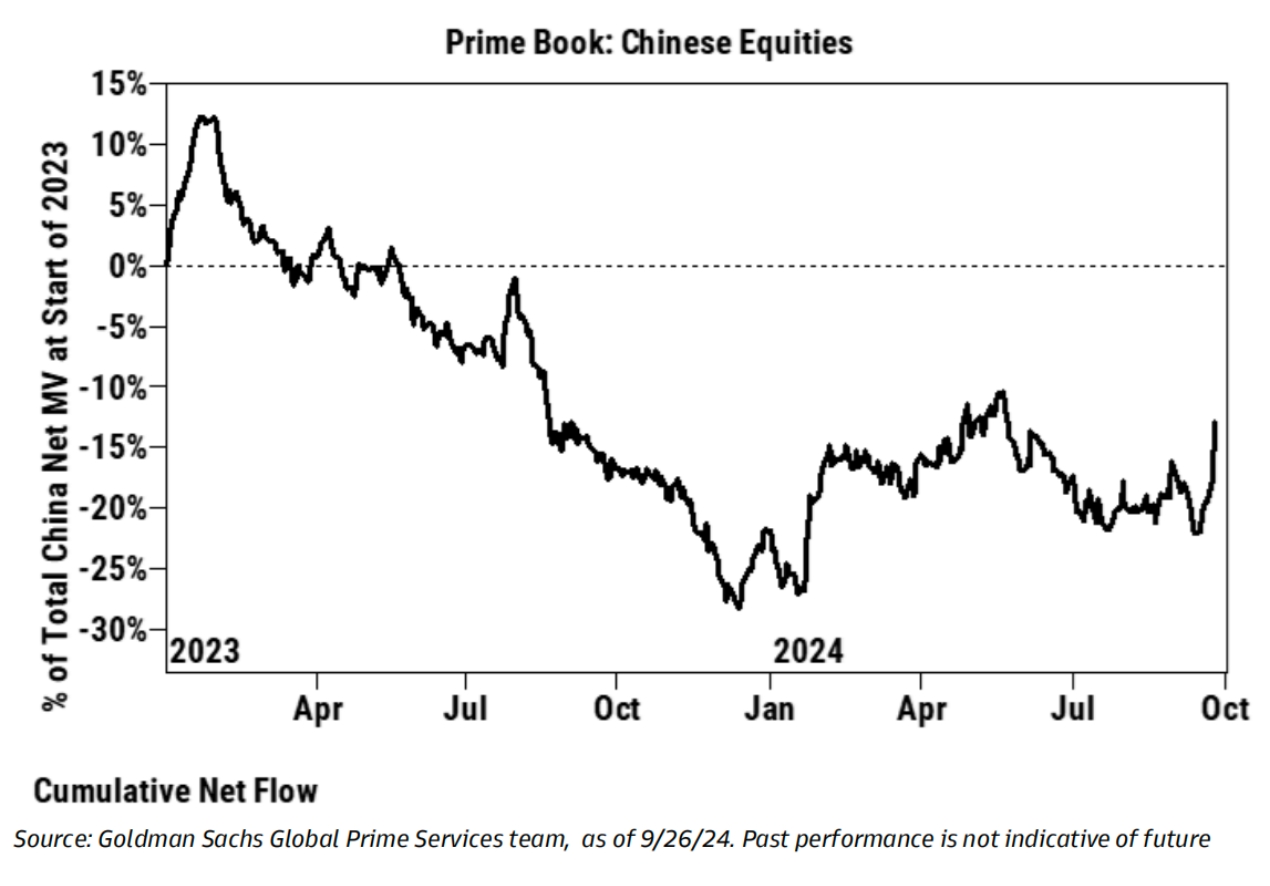

Overseas hedge funds with ultra-low allocation of Chinese assets are beginning to pour in. Goldman Sachs stated that Chinese stocks have been bought in Goldman Sachs' PB business (macro managers, quantitative and multi-strategy managers, i.e. short-term traders) for 8 consecutive days, but traditional long-term investors (long-only) have not yet started to take action. This group may be forced to increase their positioning.

Are Chinese Assets Worth Buying Now?

Valuation Levels:

According to Wind, as of September 23rd, the valuation of China Concepts Stocks stood at 17.75 times, significantly below the median valuation and opportunity value of the past five years. In comparison to historical levels, the Golden Dragon Index remains at a low point, indicating potential for growth.

*PE Chart of the China Internet 50 Index. Source: Wind.

Views from Major Banks:

International investment banks generally find the valuation of Chinese assets attractive. Major foreign institutions like JPMorgan Chase, Goldman Sachs, and UBS express strong confidence in Chinese assets. Overall, they believe that the recent policy "combination of punches" has significantly boosted both economic fundamentals and the stock market. With multiple favorable factors at play, they see this as an opportune time to invest in the Chinese stock market and are optimistic about a rebound.

Zhu Haibin, chief economist for China and head of Greater China economic research at JPMorgan, noted, "The policy released by the central bank on the 24th exceeded market expectations and was aimed at restoring market confidence."

According to JPMorgan, the average decline in existing mortgage interest rates is approximately 0.5 percentage points, which will reduce mortgage interest payments by around 150 billion yuan. The two structural monetary policy tools introduced by the central bank will enhance the ability of institutions and listed companies to secure funding and increase their stock holdings.

How to Seize Investment Opportunities

Chinese Concept Stocks:

Recently, Chinese concept stocks have performed well in the US market, especially in the tech and consumer sectors. The Nasdaq China Golden Dragon Index has risen consistently due to favourable Chinese economic policies and a shift in US Federal Reserve policy. Leading stocks like Alibaba, Baidu, and Tencent have strong fundamentals, making them worthy of investors’ attention.

ETF:

For investors looking to gain exposure to Chinese assets at a low cost, ETFs are an ideal tool. Investors can choose ETFs that track Chinese tech stocks, infrastructure, or consumer stocks. For instance, KWEB (KraneShares CSI China Internet ETF) focuses on Chinese internet companies benefiting from supportive technology policies. ETFs tracking Hong Kong or A-share large-cap stocks are also good options.

Hong Kong Stocks:

The Hong Kong market serves as an important financing platform for Chinese enterprises, with many mainland companies listed on the Hong Kong Stock Exchange. The Hong Kong financial market benefits from support from Chinese policies, particularly in the financial and real estate sectors. Many quality Hong Kong stocks are currently undervalued and have significant upside potential, such as China Construction Bank and Ping An Insurance.

Emerging Market Funds:

In the US market, ETFs reflecting emerging market performance have also strengthened due to the introduction of Chinese economic stimulus policies. Large emerging market funds, such as iShares MSCI Emerging Markets ETF (EEM) and Vanguard Emerging Markets ETF (VWO), have garnered investor attention. Recent data shows a significant increase in bullish options trading for these ETFs, indicating market optimism for emerging markets' future performance.

*T&Cs Apply. Capital at Risk. Not Investment Advice. Please visit our website for more details.